Sun Tzu, military strategist during ancient China. The author of The Art Of War.

“In the midst of chaos, there is also opportunity”. – Sun Tzu

The year 2020 is a tumultuous year for us Malaysians. With the pandemic of COVID-19 and the economic repercussions, there are uncertainties and doubts on whether it is a good time to commit for big-ticket items which in the purpose of this guide; a property of your own.

However, like all things in life, every bottom has its limit. Downsides preceded with huge upsides. Mishappening turns into fortune. Believe us when we say that first time home buyers in Malaysia are in for the greatest treats that they will ever experience.

We are aware that being a first-time buyer does not necessarily mean being a beginner. This guide serves as a structural approach in a step-by-step manner to facilitate as a basis in making your first purchase as worthy as possible, especially in this golden moment. The internet will be your best resource to continuously update your strategies and complements well with this guide.

Before We Begin, Few Assumptions To Note:

- You will be taking up a housing loan to buy your first home

- You have identified the location of your interest to settle in

- You know the type of properties that you want to be based on your priorities (career growth, family living, etc.)

Step 1: Your Budget

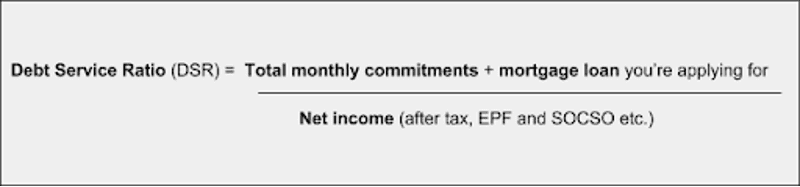

Remember to save down this important formula calculation, not only will it help you manage your monthly finances. This is what banks used to determine if you are qualified for a loan (explained further in Step 3):

For example, assuming you are:

Making a monthly income (after tax, EPF, SOCSO, etc.) of RM5,000

Paying monthly commitment of RM2,500 (commitments can be car loans, personal loans, credit cards, etc.)

Your DSR (before taking a new housing loan) will be:

DSR = RM2,500 / RM5,000 = 0.5 or 50%

Let’s say that you are buying a new house with a monthly loan commitment of RM1,000, your DSR will be:

DSR = RM2,500 + RM1,000 / RM5,000 = 0.7 or 70%

What does this mean to you?

In layman terms, the higher the DSR is, the riskier it is for you to be able to service your monthly commitment. To the bank, this formula determines whether they would approve the housing loan that you applied for. As an estimate (at this point of time), banks in Malaysia would approve the loan at a minimum of 0.6 (60%) DSR, and some banks can go as high as 0.8 (80%) DSR.

Ask any financial guru/advisor and they will tell you that as an act of prudence, allocate no more than 30% of your take home pay (monthly net income minus monthly commitment) to pay for your new housing loan monthly repayment.

It is up to you to what extent of how prudent you want to manage your finances, but make no mistake: Banks will always use this as a cardinal rule to grant you the key to the house (no pun intended).

Step 2: Finding Out The Real Cost Of Your New House

To make things simple, the general rule of thumb in buying a house comes down to this: How much do I have to pay now, and how much do I have to pay down the road.

So, assume that you wanted to buy this new house with a selling price of RM500,000. The calculation of additional substantial charges would be as follows (taking a housing loan with 90% margin, charges are estimates only):

- SPA (Sales & Purchase) Legal Fees: About RM5,000

- Loan Agreement Legal Fees: About RM4,500

- Stamp Duty on MOT: About RM9,000

- Loan Stamp Duty: About RM2,250

Notwithstanding the downpayment that you have to place (normally 10% of the selling price of the house), be mindful of other charges that will be incurred including but not limited to the below:

- Mortgage Reducing Term Assurance (MRTA)

- Fire insurance, Quit rent & assessment fees (payable annually)

- Maintenance fee & sinking fund (for properties with additional facilities, commonly exist in high-rise types like condominiums)

- Loan interest (factored in as part of your monthly loan instalment)

Step 3: Qualifying For A Loan

As mentioned in Step 1, banks use Debt Service Ratio (DSR) as a beginning, important indicator to assess if you are eligible to get a housing loan based on the applied loan margin.

The easiest and arguably the best way to find the best housing loan deal with tons of useful information and tools like loan calculators would be Loanstreet at https://loanstreet.com.my/home-loan .

Before shopping for the best housing loan though, you need to know that one of the criteria that banks normally assess your current repayment capacity is through a credit report from Bank Negara Malaysia called Central Credit Reference Information System (CCRIS). How does a CCRIS report look like?

This CCRIS report is how banks evaluate your repayment capacity. Other than calculating your monthly commitments (denoted in column K), typically a bank will look into column N to see your monthly repayment habits and column O for legal status. Anything adverse, most banks if not all will not approve your loan request. Speak to your bank loan officer to find out the best way to get your housing loan approved.

By the way, do you know now that you don’t have to obtain your own CCRIS report physically through Bank Negara Malaysia? Now, you can obtain it conveniently for free by registering directly with Bank Negara Malaysia’s eCCRIS portal at https://eccris.bnm.gov.my/ .

You Must Read This: The Sweetest Bargain Ever For First Time Home Buyers

Words cannot describe enough how privileged are first-time home buyers now. We are not talking about typical offers like free legal fees and so on. These campaigns below literally will save you so much more money and upfront commitments, that existing buyers can only look at you full of envy.

Before we outline this, it is awesome to know that at this point in time, our country’s overnight policy rate (OPR) now stands at 1.75%. If it was last year in 2019, the OPR was 3%. In other words, the housing loan interest is now lower by 1.25% which translates to cheaper instalment.

Must-Have Deal: House Ownership Campaign (HOC) 2020-2021

HOC was a government initiative designed to support homebuyers looking to purchase the property. At the same time, it also encouraged the sales of unsold properties in Malaysia’s housing market.

It was first announced in 2019 and now, Prime Minister Tan Sri Muhyiddin Yassin has announced that HOC is back, taking effect from June 2020 till May 2021.